2025 pushed the crypto industry into uncomfortable territory. Speculation faded, capital tightened, and many builders slowed their pace. Ronin chose a different response. The network leaned into real usage, infrastructure work, and long-term ecosystem strength.

Ronin by the Numbers

Ronin Market continued its robust trading activity even when it was evident that NFT conditions were deteriorating enormously throughout the whole industry. The network saw tens of millions of RON in transactions, both from presales and secondary trading. Most of this trading was initiated due to the Builder-led demand.

Several new launches provided a strong basis for market interest throughout the year. Participation was regularly attracted by Ragnarok Landverse, Fableborne, and Moki Genesis. The number of buyers increased even though the total amount of sales went down.

Town Hall speakers envisaged it as a positive development. The activity of collecting started to take over from the short-term speculation. The change had an impact on Ronin’s new product line.

Key 2025 market signals included:

- Strong presale demand across multiple releases

- Growing buyer participation despite lower spend

- Ongoing secondary activity from committed collectors

Fortune Spin and Market Experiments

Ronin introduced Fortune Spin in June as a focused experiment. The product combined onchain mechanics with physical collectibles. Engagement mattered more than token rewards.

The experiment quickly gained traction. Players completed over 200,000 spins during the year. Total volume exceeded $1.5 million.

Town Hall discussions positioned Fortune Spin as proof of hybrid demand. Physical rewards reduced speculative behavior. Engagement stayed consistent after launch.

Common Fortune Spin outcomes included:

- Trading cards and physical collectibles

- In-game items and NFTs

- Cashback and buyback incentives

Ronin Arcade and Onboarding Progress

Ronin Arcade targeted easier onboarding from day one. The experience introduced users to several games through short quests. Simplicity guided every design decision.

Season One drew over 30,000 players across eight games. Participants completed more than 70,000 quests. Early data showed strong curiosity-driven engagement.

Season Two refined the format using community feedback. Quests became more structured and beginner-friendly. Town Hall metrics showed clear onboarding improvements.

Key onboarding results included:

- Threefold growth in quests completed

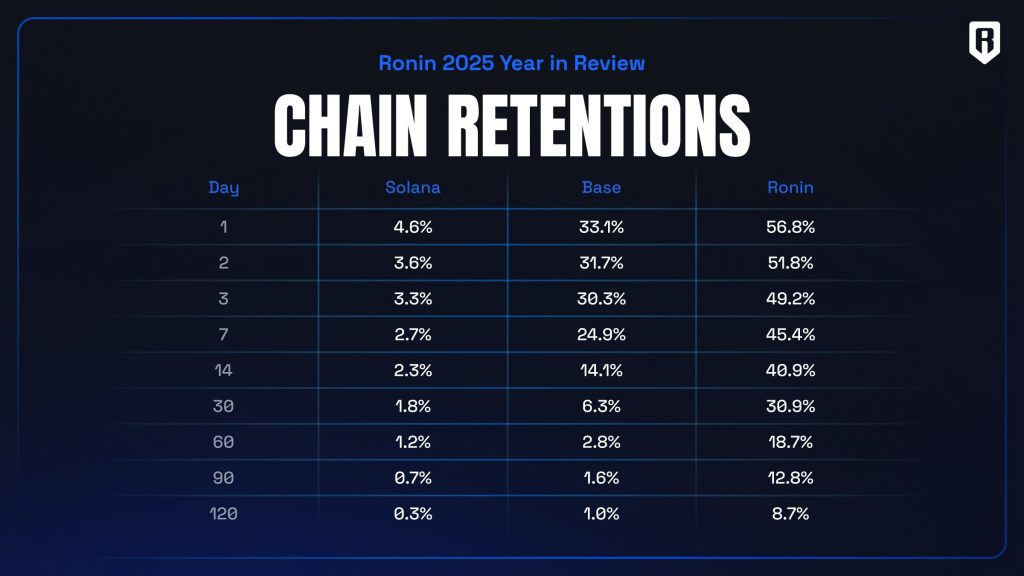

- Better retention among new players

- Multiple users reaching maximum scores

Builder Momentum After Ronin Opened

Ronin opened permissionless access in February. Nearly 1,000 teams began building soon after. Leadership framed this as a long-term ecosystem bet.

By late 2025, Ronin surpassed five million active users. Applications processed over 250 million transactions. Builders continued shipping through difficult conditions.

Town Hall speakers referenced Axie Infinity to ground expectations. Early growth once looked uncertain as well. Patience remained central to Ronin’s strategy.

Notable builder trends included:

- Seasonal economies with live updates

- Risk-to-earn gameplay experiments

- Strong conversion from Web2 audiences

Q4 2025 Economy Snapshot

The Town Hall briefly addressed Q4 market conditions. Leadership acknowledged softer volumes across crypto. They avoided isolating Ronin from broader trends.

Core activity stayed stable throughout the quarter. Daily wallets continued transacting regularly. Presale participation held up better than expected.

Ronin framed Q4 as resilient rather than weak. Lower speculation reduced volatility. Builder shipping remained consistent.

Key Q4 observations included:

- Stable daily active users

- Less speculative churn

- Continued builder deployments

What Comes Next for Ronin

Ronin confirmed its return to Ethereum using Optimism OP Stack. The move targets faster transactions and deeper liquidity. Security improvements also play a role.

Proof of Distribution will launch in 2026. Builder rewards will replace validator-focused incentives. Measured impact will drive allocation.

Performance inputs will include:

- Total value locked

- Gas usage

- New and active users

- Transaction volume

Leadership described 2026 as a transition year. Infrastructure upgrades take priority. Ronin plans to move forward through execution, not hype.